Want Higher Returns, Less Risk & More Control Over Your Money?

New Book Reveals A Contrarian (But Proven) Way To Build Legacy Wealth

New Book Reveals A Contrarian (But Proven)

Way To Build Legacy Wealth

Without Wall Street

Without Wall Street

No more getting ripped off by financial advisors, making Wall Street “fat cats” rich at your expense, or being at the mercy of market forces beyond your control.

This is how to generate above market returns, passive income, forced equity appreciation, plus tax benefits to automatically grow your retirement account.

No more getting ripped off by financial advisors, making Wall Street “fat cats” rich at your expense, or being at the mercy of market forces beyond your control.

This is how to generate above market returns, passive income, forced equity appreciation, plus tax benefits to automatically grow your retirement account.

As Featured In…

As Featured In…

How much is Wall Street ripping you off?

Not sure?

Think you’re “safe”?

Well, think again.

Millionaire rogue investor and star of A&E’s “Flipping Boston”, Dave Seymour, says…

“Nobody’s safe anymore. You’ll be shocked how the Wall Street fat cats are getting rich with your money while you get a fraction of the returns you deserve.”

Now if that sounds like a bold claim just wait…

Because after you read his new book, “Wealth Without Wall Street”...

You won’t be able to sleep at night.

Not after he shows you how they’re taking you to the cleaners.

Right under your nose, too.

(And after he reveals the alternative investment — they don’t want you to know about — that Freed him from the shackles of the Wall Street Underworld in just 1 year while building legacy wealth for generations to come.)

If you’re a white-collar professional, C-Suite exec, doctor, lawyer, or anyone invested inthe traditional financial system…

You’re their biggest “mark”.

With a nice big target on your investment accounts.

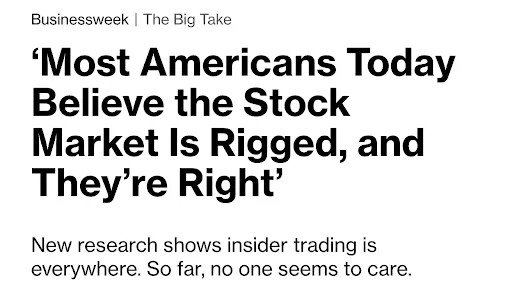

They don’t even deny it anymore.

Take a look…

CBS News reports that…

Bloomberg writes…

Yahoo Finance reveals...

Oh… you “knew” that already?

Ok.

What you don’t know is how much they’re draining YOU for…

Here’s what I mean…

Jack Bogle founded The Vanguard Group.

Which today has approximately $7.7 trillion under management.

Vanguard is the largest provider of mutual funds.

Most 401(k) plans are heavily invested in these assets.

By Bogle’s own admission, the mutual fund industry is more focused on salesmanship over stewardship in pushing 401(k) plans.

He points out that mutual funds have hidden costs and fees… which… eat into your returns… while… lining the pockets of the Wall Street fat cats with the lion’s share of the profits you should get.

The example Bogle gives is just shocking.

Say a person is 20-years-old and starts putting away $1,000 a year.

They earn 8% per year on their investment.

Over 65 years, that $1,000 will grow into about $140,000.

Sounds pretty good, right?

Well… not when you look at the numbers a little more closely.

Because according to Bogle, the mutual fund industry will take about 2.5% of that return.

Netting you only 5.5% instead of 8%.

Your $1,000 will now only return $30,000 in 65 years of investing.

Which means Wall Street gets $110,000.

Think about that.

Wall Street put up ZERO capital.

They took ZERO risk.

Yet… they pocket about 80% of your returns.

You, on the other hand, put up 100% of the risk.

You put up 100% of the capital.

But you only get a little over 20% of the return.

Does that sound fair to you?

Absolutely NOT!

This is not the only way Wall Street is robbing investors blind.

For now, consider this…

What if you could put your money in alternative assets they can’t touch and don’t control?

Like the one alternative investment class Seymour says has…

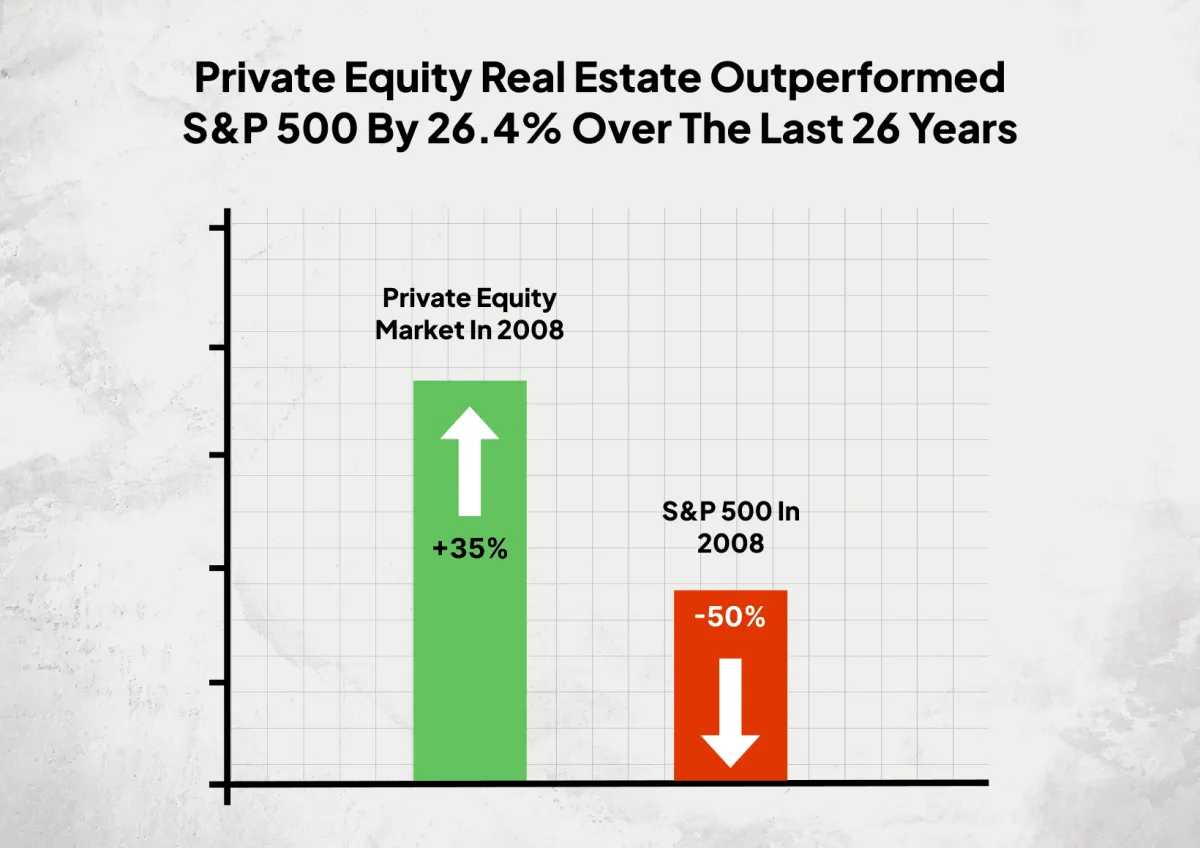

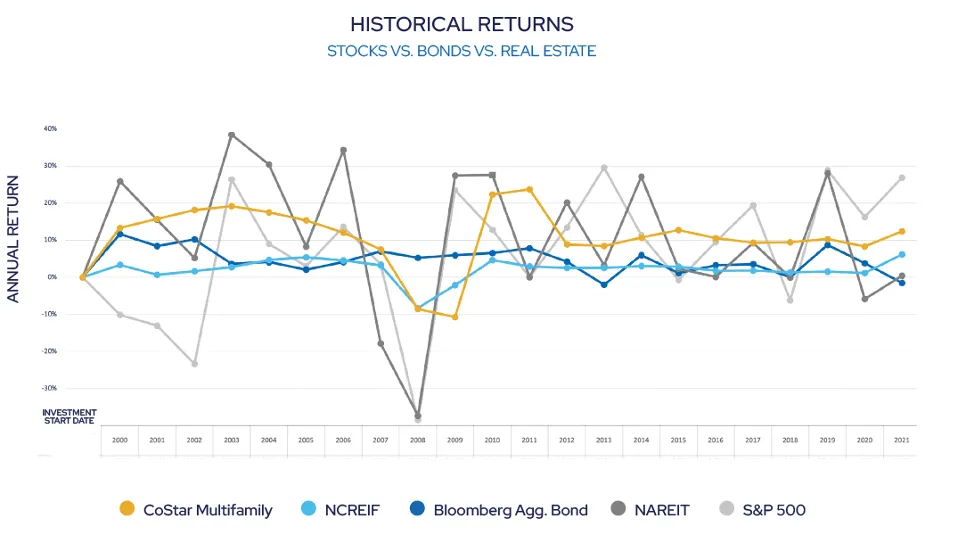

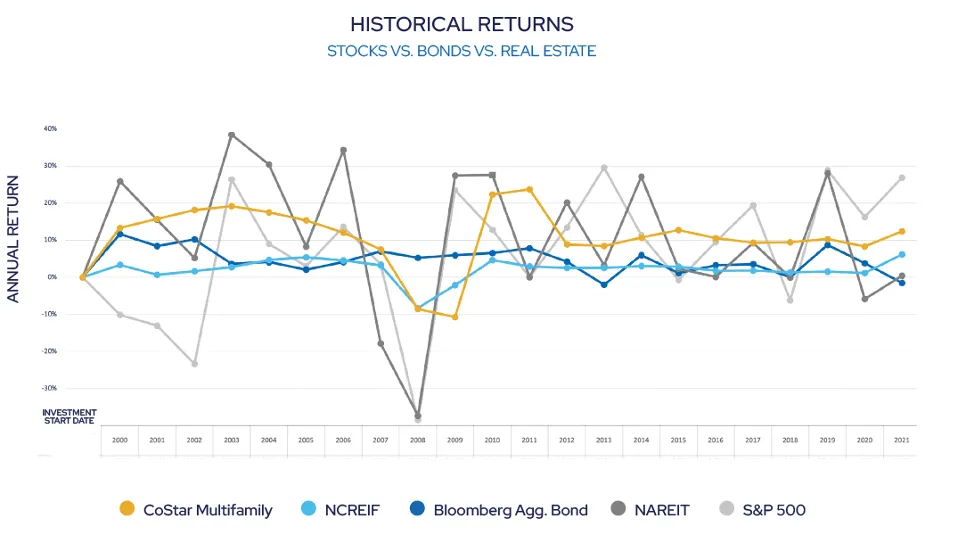

Beaten the S&P 500 by 26.4% over the past 26 years.

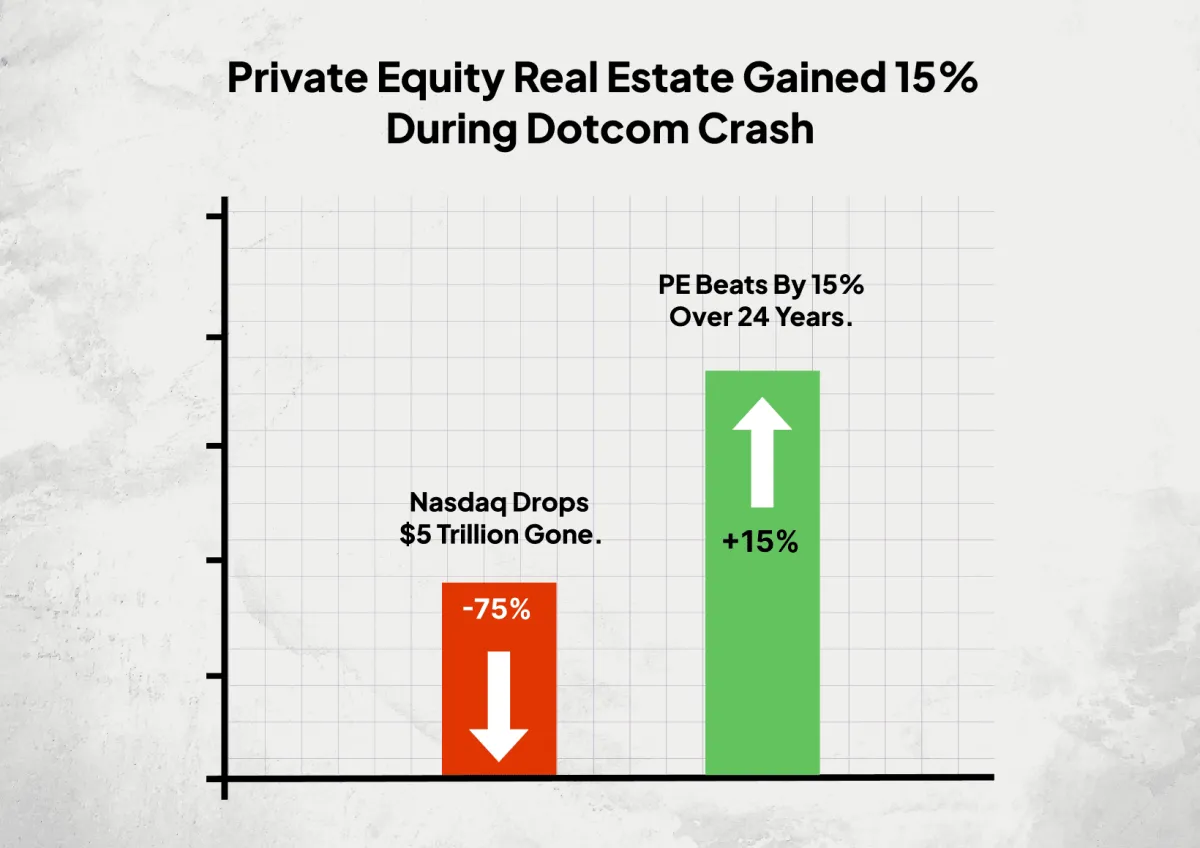

When the Dotcom crash in the early 2000s drove the market into the ground, the Nasdaq fell 75%...

Vaporizing an estimated $5-Trillion in investor wealth.

This asset class brought in returns of up to 15%.

Despite the mayhem.

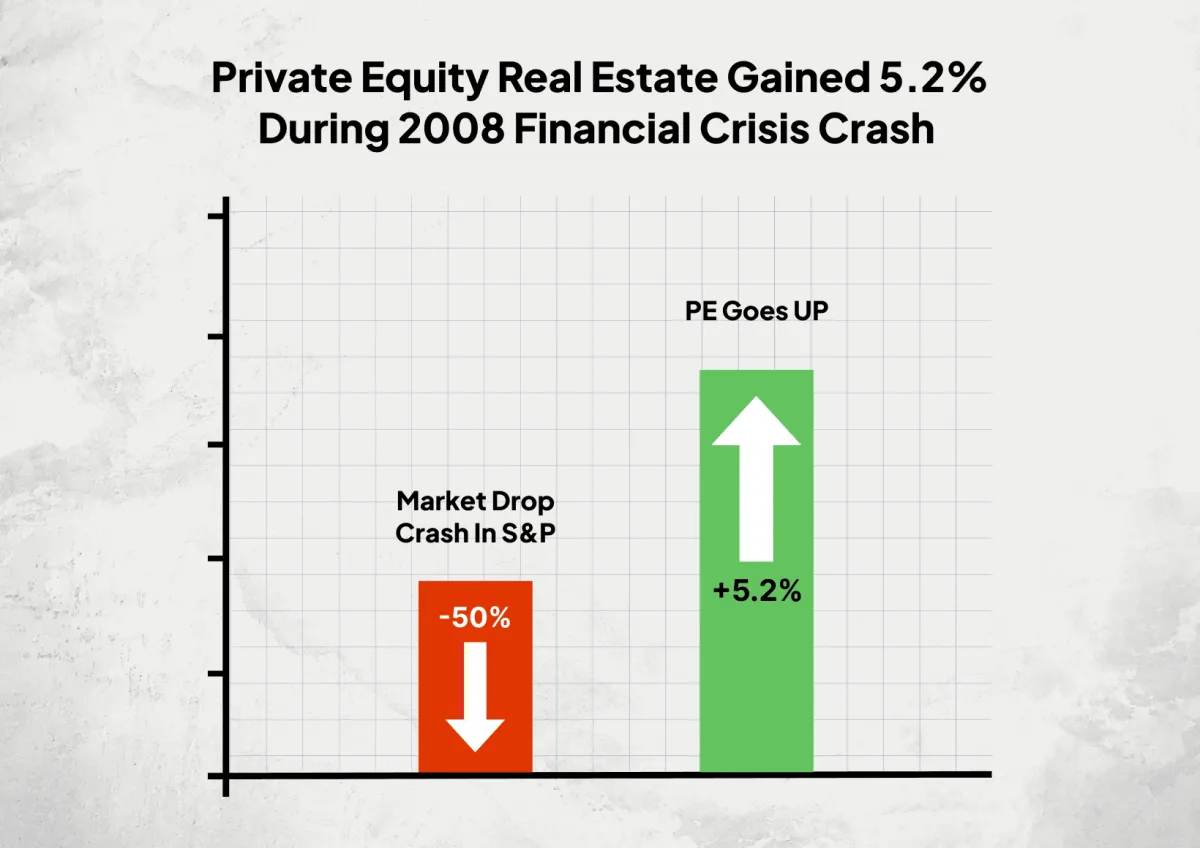

During the Financial Crisis of 2008, while the market fell more than 50% and American’s lost $10.2 trillion of wealth…

This asset class returned a positive 5.2%.

Even during the Covid Crash when stocks cratered by 34%…

Forbes said this asset class “has long held strong against uncertainty and economic swings, and the Covid-19pandemic has proven to be no exception.”

It’s not gold (or other precious metals), crypto, traditional real estate, or any of the typical investments you hear about.

This is the one investment the rich have kept to themselves.

For decades.

Because it can beat inflation, hedge against recession, and provide cash flow, appreciation, and generational wealth.

Major investors are pouring billions into this asset class now…

The Wall Street Journal reports that Blackstone — the world’s largest alternative asset manager — is investing $10 billion.

Billionaire David Rubenstein is backing an investment firm who recently raised $240 million to invest in this asset class.

According to Bloomberg, multi-billionaire Amancio Ortega (Spain’s richest man) put up $232 million to get in on the action too.

Now, this alternative investment is finally available to the rest of us.

In his new book, Wealth Without Wall Street, Seymour shows you how to take advantage of it yourself.

Of course, you may be wondering…

Who is Dave Seymour and what does his new book reveal?

Before we get to that, let’s look at a few cold hard facts.

FACT: More than half of Americans (56% according to a Bank rate survey) are behind on retirement. No wonder their number one fear is outliving their money. Which is what will happen unless they have an investment that spins out cash and builds wealth.

FACT: Inflation is destroying the buying power of the US dollar. An item that cost one dollar in 1913 costs $31.55 today. A cumulative rate of inflation of 3,054.9%. Hard to get ahead unless you have an asset that beats inflation.

FACT: Social Security is on life support with a $22 trillion (and growing) shortfall. At this rate, chances are social security might not be anywhere enough to help fund your retirement.

Before we get to that, let’s look at a few cold hard facts.

Let’s not forget that pensions are a thing of the past.

And our country’s debt is spiraling out of control.

Almost impossible to make any headway financially under these circumstances.

Much less leave a legacy that can last for generations.

All of these factors have led to warnings from financial experts who advise ditching traditional assets for alternative assets before it’s too late.

That’s why Seymour is sounding the alarm.

He is considered as one of the foremost experts on this alternative asset class.

Seymour wasn’t born with a “silver spoon” in his mouth.

He came from a working-class family.

In 1986, he immigrated from London, England to the Boston area.

He took a good government job that turned into a trap.

Sixteen years later, he was 36 years old, married with a kid, and having a hard time making ends meet.

He worked two to three jobs but still couldn’t get out of debt.

Then things went from bad to worse.

He got sucked into the subprime lending scam back in 2006. Which led to his house getting foreclosed. He had $70,000 in unsecured debt and planned on short-selling his property.

The American Dream became a daily nightmare for Seymour

(like it was for millions of Americans)

But he pressed on.

By chance, he heard a “Teach Me Foreclosures” radio ad. He attended the event and the rest is history.

Did his first wholesale deal in 2008 that paid him $5,000.

He went “all in” and learned everything he could about real estate investing.

Which landed him a leading role in A&E’s “Flipping Boston.”

Here’s where things really took a turn…

See, it became obvious to Seymour that fixing and flipping houses was NOT where the real money was.

Wholesaling, rehabbing and all of residential real estate investing is nothing more than a glorified job that requires constant hustle and grind.

Seymour discovered an even better way to profit.

From an alternative asset reserved for the rich until recently.

That alternative investment is… Multi-Family Property.

Today, Seymour’s private fund manages 1,600 units worth $346-million.

And he’s on a mission to teach others how to achieve financial freedom through strategic multi-family investing.

Now, if you know nothing about Multi-Family investing, you might think it’s daunting, risky and overwhelming.

Seymour has figured out how to make it accessible to the rest of us.

That’s why he wrote his new book…

Wealth Without Wall Street: The Ultimate Blueprint For Building Legacy Wealth with Multi-Family Apartments

You’ll discover the secrets to above market returns, passive income, automatic equity, plus tax benefits to grow your retirement.

Without the Wall Street “fat cats” getting rich at your expense.

This is how the rich build wealth outside of Wall Street.

Within its pages, you’ll see how to:

Generate a stream of “retirement royalties” anchored in stable cash flow, scalable passive income, and tax advantages that put more money in your bank and retirement account.

Compound rental income to turn your properties into high-profit family heirlooms that gain value with each passing generation. (Providing for your family now and securing financial comfort decades into the future.)

Build an empire robust enough to weather economic storms yet flexible enough to adapt and evolve. (So you can cultivate wealth wisely and sustain it through market cycles and changes in personal circumstances.)

Create strategic partnerships and a team of skilled professionals who will help boost your investment's success and efficiency.

Access lucrative multi-family market opportunities… even if… your initial capital doesn't stretch as far as you think it should. (The truth is the multifamily market is as accessible as it is profitable.)

Recognize a solid investment with outsized potential and avoid “money pit” deals that can put you out of business before you get started.

Build a portfolio that stands the test of time by balancing the immediate operational needs of your properties with long-term growth strategies.

Master property management without getting bogged down in the details by hiring the right dedicated property management team. (These professionals can turn potential financial turmoil into a steady stream of income.)

Turn properties into magnets for quality tenants willing to pay premium rents. (Knowing which enhancements to make increases both rental income and the property’s value.)

We’ll get back to more of what this remarkable book will teach in you in a moment. But first, let’s talk about…

Why Now Is The Time To Get Informed

America is losing its status as the world leader.

A number of nations want the dollar replaced as the world’s reserve currency. Should that happen, you’d better have your money in assets that hold real value. Multi-family is simply one of the very best.

With the printing presses on stand-by, the Fed could easily wipe out even more of the value of each dollar in your retirement account.

The $34-trillion in debt saddling our nation only adds fuel to the fire.

You need a hedge against the financial insanity.

In Wealth Without Wall Street, you’ll discover how to:

Follow a systematic approach to finding the right multifamily properties that bring you closer to financial freedom and a retirement most people would envy.

Accelerate portfolio growth by strategically leveraging and reinvesting equity from existing properties to fund the acquisition of new ones while maintaining a balance between growth and risk management.

Assess and research potential markets with promising demographics and economic indicators… so… you buy properties with potential for outsized growth for decades to come.

Implement a simple blueprint for successful property acquisition. (Follow these 10 steps to curate a portfolio that grows and allows for long-term wealth creation.)

Craft an exit strategy before investing so you can navigate your investment journey with foresight and sell at the most opportune time.

Seek wise counsel and mentorship from those who have walked the path before you. (A crucial step in identifying the practices that guide you to success while avoiding common missteps.

Structure investments with a vision for future generations and the importance of estate planning and asset protection in safeguarding wealth.(This is how you fortify your investments and ensure your financial endeavors withstand the test of time and serve generations to come.)

Protect your wealth through legal structures savvy investors rely on to shield assets from potential threats. (Now, you can rest assured your legacy is not left to chance.)

Sustain wealth across generations through a sound approach that allows your legacy to withstand market volatility and the test of time across.

Can you guess the biggest reason the vast majority of people struggle to get ahead (and stay ahead) financially?

It's Because The System Is Rigged Against Them And No One Has Shown How To Break Free

Every investment tied to the “paper asset” market is vulnerable.

Stocks, mutual funds, bonds… you name it.

They are all controlled and manipulated by Wall Street.

If you’ve ever wondered how the “fat cats” get rich after a crash — while everyone else is licking their wounds — it’s because the market manipulators know how to profit at your expense.

But, after you read Wealth Without Wall Street, you’ll know…

How to NEVER again be a “mark” for Wall Street’s white-collar crooks.

Seymour’s new book is like a light at the end of a long dark tunnel.

Guiding those who read it to the pot of gold at the end of the rainbow.

Get your copy and discover how to:

Make your investments serve as both a standalone provider of cash flow and also as a stepping stone to your next venture.

Stay ahead of trends such as market fluctuations, technological advancements, and changing tenant preferences to maintain competitiveness and growth.

Maintain stable cash flows and asset values during economic downturns… while… using digital solutions to optimize your portfolio's performance and maximize returns.

Diversify your portfolio across different markets, property types, or tenant demographics to mitigate risks and provide a buffer against uncertainties.

Recognize the patterns of success and adapt proven strategies other investors are using to build their portfolios in different market situations. (And learn from “Other People’s Mistakes”, see where they stumbled, and adjust your strategy to maintain continued profits.)

Gain control over your financial destiny with dynamic opportunities within the multifamily sector that very few investors will ever know about.

Cultivate an ability to predict market shifts before they happen. (Developing such foresight is what separates enduring successes from fleeting achievements in the realm of multifamily investing.)

Harness a wealth-building mindset (that invincible attitude) which tilts the

scales of wealth creation in your favor.

Become a wealth creator by understanding market cycles, deal structuring, and managing assets for sustainable cash flow, appreciation, and long term growth.

“Are These Alternative Investments Right For Me?”

At this point you might be wondering…

Maybe.

Maybe not.

How will you know unless you do a little research?

Seymour wrote this book to educate everyone trapped in the stock market about how to take back control of their financial destiny.

Because if you don’t…

You will be at the mercy of forces beyond your control.

Besides, these investments are now more accessible than ever.

To ALL of us.

Not just the biggest income earners.

The playing field has been leveled to a great extent.

Wealth Without Wall Street: The Ultimate Blueprint For Building Legacy Wealth with Multi-Family Apartments…

Reveals the step-by-step system for cash flowing multi-family property… while… building generational wealth in ways that can’t be done with any other investment class.

The best part is…

It’s Easy To Get Your Copy…

The wealth-building secrets in this book are hard to come by.

It would take a lifetime of experience to learn them on your own.

Not to mention countless mistakes that could cost an arm and a leg.

That’s why Seymour has decided to make Wealth Without Wall Street available to everyone.

So they can learn from his proven system for investing in cash-flowing multi-family property that builds wealth for generations.

And he’s decided to make it available at such a low price…

It’ll make your jaw drop.

To get your copy, simply put down a small deposit of just… $5.

About the cost of two cups of coffee.

For a chance at learning the alternative investment secrets of a real multi-family multi-millionaire.

You have no real “risk” in this deal anyway.

Because, if you don’t think this book can help you get a solid grasp of the multi-family investment opportunities in today’s market…

Simply request a refund within the next 30 days.

You’ll get every penny back… and… you can keep the book with our compliments.

We’ve come full circle, and you have a decision to make.

Spend some “pocket change” and discover how to gain control of your financial destiny and build wealth without Wall Street…

Or…

Shrug your shoulders, leave here empty-handed, and keep getting victimized by the white-collar crooks in control of the “paper” markets.

The choice is yours.

But choices do have consequences.

I know you’ll make the right one, and I’ll even help you out.

Just go ahead and…

How much is Wall Street ripping you off?

Not sure?

Think you’re “safe”?

Well, think again.

Millionaire rogue investor and star of A&E’s “Flipping Boston”, Dave Seymour, says…

“Nobody’s safe anymore. You’ll be shocked how the Wall Street fat cats are getting rich with your money while you get a fraction of the returns you deserve.”

Now if that sounds like a bold claim just wait…

Because after you read his new book,

“Wealth Without Wall Street”...

You won’t be able to sleep at night.

Not after he shows you how they’re taking you to the cleaners.

Right under your nose, too.

(And after he reveals the alternative investment — they don’t want you to know about — that Freed him from the shackles of the Wall Street Underworld in just 1 year while building legacy wealth for generations to come.)

If you’re a white-collar professional, C-Suite exec, doctor, lawyer, or anyone invested in the traditional financial system…

You’re their biggest “mark”.

With a nice big target on your investment accounts.

They don’t even deny it anymore.

Take a look…

CBS News reports that…

Bloomberg writes…

Yahoo Finance reveals...

Oh… you “knew” that already?

Ok.

What you don’t know is how much they’re draining YOU for…

Here’s what I mean…

Jack Bogle founded The Vanguard Group.

Which today has approximately $7.7 trillion under management.

Vanguard is the largest provider of mutual funds.

Most 401(k) plans are heavily invested in these assets.

By Bogle’s own admission, the mutual fund industry is more focused on salesmanship over stewardship in pushing 401(k) plans.

He points out that mutual funds have hidden costs and fees… which… eat into your returns… while… lining the pockets of the Wall Street fat cats with the lion’s share of the profits you should get.

The example Bogle gives is just shocking.

Say a person is 20-years-old and starts putting away $1,000 a year.

They earn 8% per year on their investment.

Over 65 years, that $1,000 will grow into about $140,000.

Sounds pretty good, right?

Well… not when you look at the numbers a little more closely.

Because according to Bogle, the mutual fund industry will take about 2.5% of that return.

Netting you only 5.5% instead of 8%.

Your $1,000 will now only return $30,000 in 65 years of investing.

Which means Wall Street gets $110,000.

Think about that.

Wall Street put up ZERO capital.

They took ZERO risk.

Yet… they pocket about 80% of your returns.

You, on the other hand, put up 100% of the risk.

You put up 100% of the capital.

But you only get a little over 20% of the return.

Does that sound fair to you?

Absolutely NOT!

This is not the only way Wall Street is robbing investors blind.

For now, consider this…

What if you could put your money in alternative assets they can’t touch and don’t control?

Like the one alternative investment class Seymour says has…

Beaten the S&P 500 by 26.4% over the past 24 years.

When the Dotcom crash in the early 2000s drove the market into the ground, the Nasdaq fell 75%...

Vaporizing an estimated $5-Trillion in investor wealth.

This asset class brought in returns of up to 15%.

Despite the mayhem.

During the Financial Crisis of 2008, while the market fell more than 50% and American’s lost $10.2 trillion of wealth…

This asset class returned a positive 5.2%.

Even during the Covid Crash when stocks cratered by 34%…

Forbes said this asset class “has long held strong against uncertainty and economic swings, and the Covid-19pandemic has proven to be no exception.”

It’s not gold (or other precious metals), crypto, traditional real estate, or any of the typical investments you hear about.

This is the one investment the rich have kept to themselves.

For decades.

Because it can beat inflation, hedge against recession, and provide cash flow, appreciation, and generational wealth.

Major investors are pouring billions into this asset class now…

The Wall Street Journal report that Blackstone - the world largest alternative asset manager - is investing $10 billion.

Billionaire David Rubenstein is backing an investment firm who recently raised $250 million to invest in this asset class

According to Bloomberg, multi billionaire Amancio Ortega (spain's richest man) put up $232 million to get in on the action too.

Now, this alternative investment is finally available to the rest of us.

In his new book, Wealth Without Wall Street, Seymour shows you how to take advantage of it yourself.

Of course, you may be wondering…

Who is Dave Seymour and what does his new book reveal?

Before we get to that, let’s look at a few cold hard facts.

FACT: More than half of Americans (56% according to a Bank rate survey) are behind on retirement. No wonder their number one fear is outliving their money. Which is what will happen unless they have an investment that spins out cash and builds wealth.

FACT: Inflation is destroying the buying power of the US dollar.

An item that cost one dollar in 1913 costs $31.55 today. A cumulative rate of inflation of 3,054.9%. Hard to get ahead unless you have an asset that beats inflation.

FACT: Social Security is on life support with a $22 trillion (and growing) shortfall. At this rate, chances are social security might not be anywhere enough to help fund your retirement.

Let’s not forget that pensions are a thing of the past.

And our country’s debt is spiraling out of control.

Almost impossible to make any headway financially under these circumstances.

Much less leave a legacy that can last for generations.

All of these factors have led to warnings from financial experts who advise ditching traditional assets for alternative assets before it’s too late.

That’s why Seymour is sounding the alarm.

He is considered as one of the foremost experts on this alternative asset class.

Seymour wasn’t born with a “silver spoon” in his mouth.

He came from a working-class family.

In 1986, he immigrated from London, England to the Boston area.

He took a good government job that turned into a trap.

Sixteen years later, he was 36 years old, married with a kid, and having a hard time making ends meet.

He worked two to three jobs but still couldn’t get out of debt.

Then things went from bad to worse.

He got sucked into the subprime lending scam back in 2006.

Which led to his house getting foreclosed. He had $70,000 in unsecured debt and planned on short-selling his property.

The American Dream became a daily nightmare for Seymour

(like it was for millions of Americans)

But he pressed on.

By chance, he heard a “Teach Me Foreclosures” radio ad. He attended the event and the rest is history.

Did his first wholesale deal in 2008 that paid him $5,000.

He went “all in” and learned everything he could about real estate investing.

Which landed him a leading role in A&E’s “Flipping Boston.”

Here’s where things really took a turn…

See, it became obvious to Seymour that fixing and flipping houses was NOT where the real money was.

Wholesaling, rehabbing and all of residential real estate investing is nothing more than a glorified job that requires constant hustle and grind.

Seymour discovered an even better way to profit.

From an alternative asset reserved for the rich until recently.

That alternative investment is… Multi-Family Property.

Today, Seymour’s private fund manages 1,600 units worth $346-million.

And he’s on a mission to teach others how to achieve financial freedom through strategic multi-family investing.

Now, if you know nothing about Multi-Family investing, you might think it’s daunting, risky and overwhelming.

Seymour has figured out how to make it accessible to the rest of us.

That’s why he wrote his new book…

Wealth Without Wall Street: The Ultimate Blueprint For Building Legacy Wealth with Multi-Family Apartments

You’ll discover the secrets to above market returns, passive income, automatic equity, plus tax benefits to grow your retirement.

Without the Wall Street “fat cats” getting rich at your expense.

This is how the rich build wealth outside of Wall Street.

Within its pages, you’ll see how to:

Generate a stream of

“retirement royalties”

anchored in stable cash flow, scalable passive income, and tax advantages that put more

money in your bank and retirement account.

Compound rental income to turn your properties into high-profit family heirlooms

that gain value with each passing generation. (Providing for your family now and securing financial comfort decades into the future.)

Build an empire robust enough to weather economic storms

yet flexible enough to adapt and evolve. (So you can cultivate wealth wisely and sustain it through market cycles and changes in personal circumstances.)

Create strategic partnerships and a team of skilled professionals who will help boost your investment's success and efficiency.

Access lucrative multi-family market opportunities… even if… your initial capital doesn't stretch as far as you think it should. (The truth is the multifamily market is as accessible as it is profitable.)

Recognize a solid investment with outsized potential and avoid “money pit” deals that can put you out of business before you get started.

Build a portfolio that stands the test of time by balancing the immediate operational needs of your properties with long-term growth strategies.

Master property management without getting bogged down in the details by hiring the right dedicated property management team. (These professionals can turn potential financial turmoil into a steady stream of income.)

Turn properties into magnets for quality tenants willing to pay premium rents. (Knowing which enhancements to make increases both rental income and the property’s value.)

We’ll get back to more of what this remarkable book will teach in you in a moment. But first, let’s talk about…

Why now is the time to get informed

America is losing its status as the world leader.

A number of nations want the dollar replaced as the world’s reserve currency. Should that happen, you’d better have your money in assets that hold real value. Multi-family is simply one of the very best.

With the printing presses on stand-by, the Fed could easily wipe out even more of the value of each dollar in your retirement account.

The $34-trillion in debt saddling our nation only adds fuel to the fire.

You need a hedge against the financial insanity.

In Wealth Without Wall Street, you’ll discover how to:

Follow a systematic approach to finding the right multifamily properties that bring you closer to financial freedom and a retirement most people would envy.

Accelerate portfolio growth by strategically leveraging and reinvesting equity from existing properties to fund the acquisition of new ones while maintaining a balance between growth and risk management.

Assess and research potential markets with promising demographics and economic indicators… so… you buy properties with potential for outsized growth for decades to come.

Implement a simple blueprint for successful property acquisition. (Follow these 10 steps to curate a portfolio that grows and allows for long-term wealth creation.)

Craft an exit strategy before investing so you can navigate your investment journey with foresight and sell at the most opportune time.

Seek wise counsel and mentorship from those who have walked the path before you. (A crucial step in identifying the practices that guide you to success while avoiding common missteps.

Structure investments with a vision for future generations and the importance of estate planning and asset protection in safeguarding wealth.(This is how you fortify your investments and ensure your financial endeavors withstand the test of time and serve generations to come.)

Protect your wealth through legal structures savvy investors rely on to shield assets from potential threats. (Now, you can rest assured your legacy is not left to chance.)

Sustain wealth across generations through a sound approach that allows your legacy to withstand market volatility and the test of time across.

Can you guess the biggest reason the vast majority of people struggle to get ahead (and stay ahead) financially?

It’s Because The System Is Rigged Against Them And No One Has Shown Them How To Break Free

Every investment tied to the “paper asset” market is vulnerable.

Stocks, mutual funds, bonds… you name it.

They are all controlled and manipulated by Wall Street.

If you’ve ever wondered how the “fat cats” get rich after a crash — while everyone else is licking their wounds — it’s because the market manipulators know how to profit at your expense.

But, after you read Wealth Without Wall Street, you’ll know…

How to NEVER again be a “mark” for Wall Street’s white-collar crooks.

Seymour’s new book is like a light at the end of a long dark tunnel.

Guiding those who read it to the pot of gold at the end of the rainbow.

Get your copy and discover how to:

Make your investments serve as both a standalone provider of cash flow and also as a stepping stone to your next venture.

Stay ahead of trends such as market fluctuations, technological advancements, and changing tenant preferences to maintain competitiveness and growth.

Maintain stable cash flows and asset values during economic downturns… while… using digital solutions to optimize your portfolio's performance and maximize returns.

Diversify your portfolio across different markets, property types, or tenant demographics to mitigate risks and provide a buffer against uncertainties.

Recognize the patterns of success and adapt proven strategies other investors are using to build their portfolios in different market situations. (And learn from “Other People’s Mistakes”, see where they stumbled, and adjust your strategy to maintain continued profits.

Gain control over your financial destiny with dynamic opportunities within the multifamily sector that very few investors will ever know about.

Cultivate an ability to predict market shifts before they happen (Developing such foresight is what separates enduring successes from fleeting achievements in the realm of multifamily investing.)

Harness a wealth-building mindset (that invincible attitude) which tilts the scales of wealth creation in your favor.

Become a wealth creator by understanding market cycles, deal structuring, and managing assets for sustainable cash flow, appreciation, and long term growth.

At this point you might be wondering…

“Are these alternative investments right for me?”

Maybe.

Maybe not.

How will you know unless you do a little research?

Seymour wrote this book to educate everyone trapped in the stock market about how to take back control of their financial destiny.

Because if you don’t…

You will be at the mercy of forces beyond your control.

Besides, these investments are now more accessible than ever.

To ALL of us.

Not just the biggest income earners.

The playing field has been leveled to a great extent.

Wealth Without Wall Street: The Ultimate Blueprint For Building Legacy Wealth with Multi-Family Apartments…

Reveals the step-by-step system for cash flowing multi-family property… while… building generational wealth in ways that can’t be done with any other investment class.

The best part is…

It’s Easy To Get Your Copy…

The wealth-building secrets in this book are hard to come by.

It would take a lifetime of experience to learn them on your own.

Not to mention countless mistakes that could cost an arm and a leg.

That’s why Seymour has decided to make Wealth Without Wall Street available to everyone.